The Challenge

Developing OCL required overcoming several industry-specific challenges, including:

- Manual Cargo invoicing Processing Delays: Automating the invoice generation process to reduce errors and delays.

- Complex Supplier & Client Transactions: Managing multiple stakeholders with different payment terms and agreements.

- Multi-Currency & Tax Compliance: Ensuring international transactions comply with varied tax laws and regulations.

- Lack of Real-Time Financial Visibility: Providing accurate and real-time financial tracking for suppliers and clients.

- Security & Data Protection: Implementing stringent security measures to safeguard sensitive financial data.

If you’re facing similar challenges in your business, our skilled developers are here to help. We build tailored Custom SaaS Applications designed to solve your problems and drive results. Here’s how we tackled this challenge and delivered the best outcome for our client.

Hours delivered back to the business

SOX compliance in Settlement process automation

Success rate of bot case completion

For functional release of OBT, RTS and OGS

What did

Krptoninc do

The platform was implemented in structured phases to ensure seamless adoption and efficiency:

- Stakeholder Integration: Onboarded suppliers and clients with a tailored invoicing system.

- Automated Workflow Implementation: Developed automated triggers for invoice generation and payment reminders.

- Compliance & Security Audits: Ensured tax regulations, multi-currency support, and data security measures were in place.

The Results

- Faster Invoice Processing

- Seamless Supplier-Client Transactions

- Global Compliance & Multi-Currency Support

- Real-Time Financial Insights

- Enhanced Security & Data Integrity

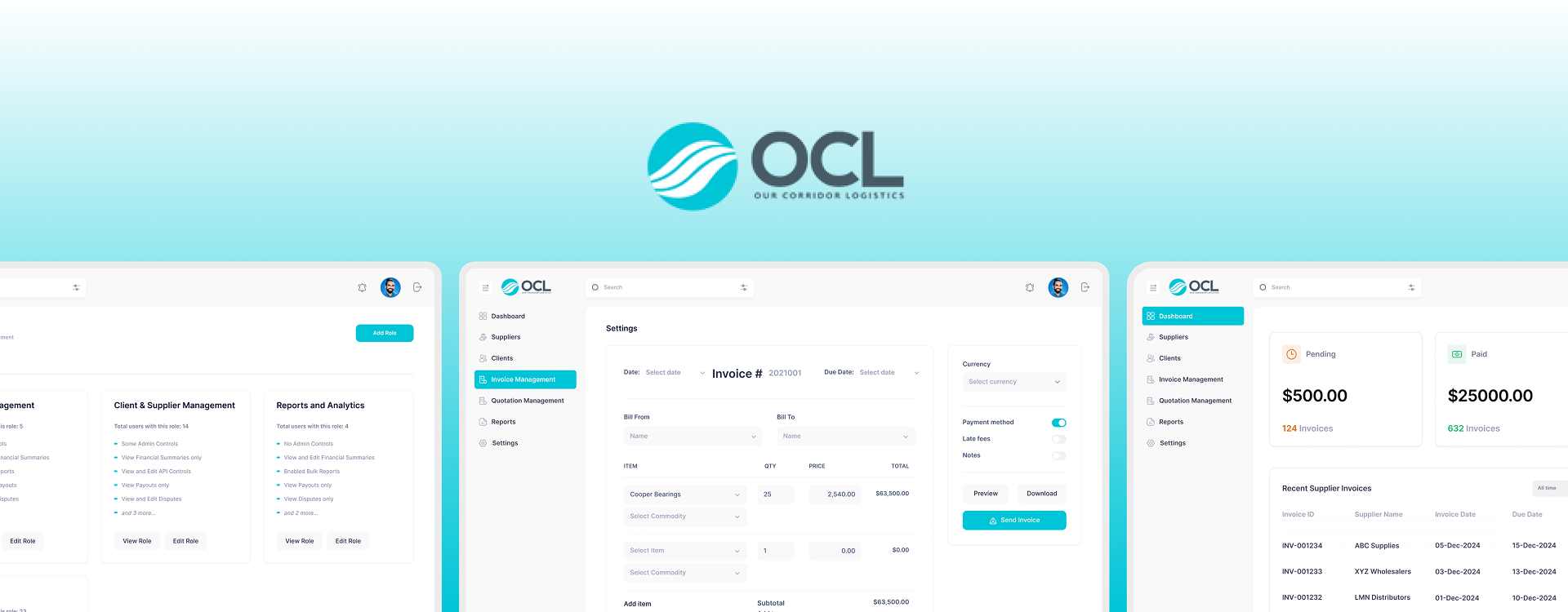

OCL was developed to overcome the challenges associated with cargo invoicing in the logistics and freight industry. Managing invoices manually in a sector that involves multiple suppliers, clients, and international transactions often results in delays, errors, and compliance risks. These inefficiencies not only slow down operations but also lead to financial discrepancies and increased administrative burdens.

Recognizing the need for a more efficient approach, OCL was designed as an advanced cargo invoicing solution that automates invoice generation, payment tracking, and tax compliance. By streamlining these critical processes, OCL eliminates human errors, reduces processing time, and ensures accurate, regulation-compliant invoicing across multiple regions and currencies.

With real-time financial insights, automated billing workflows, and seamless integration with existing logistics systems, OCL empowers businesses to manage their cargo invoicing operations with precision and ease. This results in improved cash flow management, faster payment cycles, and enhanced transparency, making OCL an essential tool for modern logistics and freight companies. View more case studies.

The technology that we use to support Paysafe

Ready to reduce your technology cost?